It’s no secret: we like to cruise. A lot. That’s why you might be surprised to hear that for the first several years, we never purchased travel insurance. We’re detailed planners and generally healthy people; what could go wrong? Unfortunately, we found out the hard way that things aren’t always within our control!

Rocky Missed the Boat!

In 2017, Rocky was flying to Miami for a sailing on board Carnival Splendor. Because we’re planners, he was flying in with plenty of time to spare. Well, you might remember the headlines about the Atlanta airport catching fire? Yup, Rocky was there! The entire airport went into a blackout and all flights were grounded for an entire day.

With no alternatives, Rocky got a hotel room to determine next steps, rented a car, drove across the state, booked a last-minute international flight and met up with the ship in Nassau, Bahamas.

100% out of pocket.

Because we didn’t have travel insurance, we either lost out on 100% of the cruise fare already paid or had to spend the money to get Rocky to the port. Since the cruise was already paid for, the second option made the most sense.

If we would have had travel insurance, all of those expenses could have been submitted. This one incident would have covered the cost of travel insurance for years.

Mark’s Appendicitis at Sea

Did we learn our lesson and purchase travel insurance? Nope. Some might say naïve. We say DUMB! Fast forward a year and a half later and I’m sailing with my brother on board Carnival Magic when I started having sharp pains in my side. After a couple hours, I finally had to go down to the medical center.

After running multiple tests, they gave me the bad news: it was appendicitis. They were running additional tests to understand if it had ruptured; if that were the case, I’d need to be AIR LIFTED OFF THE SHIP to receive urgent medical care.

In addition to not feeling well, you can imagine the anxiety that caused. I searched to see what it would cost to be airlifted off of a ship. Because we were still somewhat close to port, the estimates were about $20,000.

Thankfully, the tests came back shortly after and my appendix had not burst and the medical team was able to give me high-dose antibiotics so that I would be ok until I got back to land (I later had my appendix out in Phoenix).

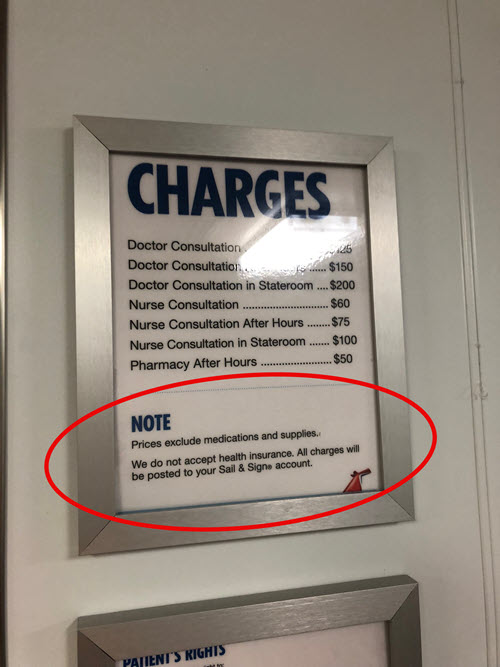

Did you know: Cruise ships do not accept medical insurance?

Cruise ships don’t accept medical insurance. It’s posted before you even enter the medical facility. Like Rocky, all of my medical expenses on board went onto my personal credit card. Once again, had we invested in travel insurance, I could have filed a claim for reimbursement with the travel insurance company.

While it sucked, it would have been far worse had I needed a medical evacuation. Without travel insurance, that would have had a serious financial impact on our lives and would have taken us years to recover.

In fact, had I needed to be airlifted, that would likely have exceeded the cost of travel insurance across my lifetime. Mind blown.

Buying the Right Policy

When looking at travel insurance, it’s important you purchase the right protection. While every cruise line will offer you travel insurance, we strongly recommend considering a per-trip or annual plan that covers all travel. Considering many fly or drive long distances to reach a port, having a plan that protects the entire trip can be a lifesaver.

Per Trip

I plan to take 1-2 trips/year

- Purchase up to 3 days before travel

- Only pay for coverage when you need it

- Less expensive than annual plan

Annual Plan

I plan to take 3 or more trips/year

- Purchase up to 3 days before travel

- Covers all travel throughout the year

- Peace of mind; purchase once to cover all travel

We love the annual plan because it covers ALL of our travel, not just our cruises. Flights, train rides, car trips across the Southwest, trips to see family in the Midwest… Every trip is always covered. That means we don’t purchase the supplemental insurance airlines or cruise lines try to sell, etc.

While these are two plans we recommend, if you look at others, it’s important to confirm that medical evacuation is included in the policy. While most plans will come with things like trip cancelation/interruption, lost/delayed baggage, transit delays/cancelations – not all cover medical evac.

The Benefits of Having a Trusted Travel Partner

A trusted travel advisor will help ensure you’re thinking about all of the things you need to plan for with your upcoming cruise without costing you a penny. It’s why we created This Cruise Life Travel Services and got agency certified – so we could lend our cruise and travel expertise to make sure you have the best vacation possible! We always recommend travel insurance to ensure you’re protected along the way should the unforeseen happen.

Ok, But Do I Really Need Travel Insurance?

YES!!! Don’t be a Mark and Rocky. Learn the valuable lesson from our mistakes and make sure you and your loved ones are covered the next time you take a cruise or wherever vacation travel takes you.

Note: Buying a travel insurance plan through the links above help keep our small website running via affiliate links. It doesn’t cost anything extra, but makes a big difference for a small business like ours. Thank you for your support!

Didn’t know there were annual plans. Teaching an old dog new tricks

Ah yes. Absolutely! Can definitely save you money in the long run – if you have several trips throughout the year!